AcuLoan Integration with Acumatica

AcuLoan for Acumatica refers to a loan management solution specifically designed to integrate with the Acumatica enterprise resource planning (ERP) system. Acumatica is a cloud-based ERP platform that provides businesses with comprehensive financial, operational, and customer management capabilities.

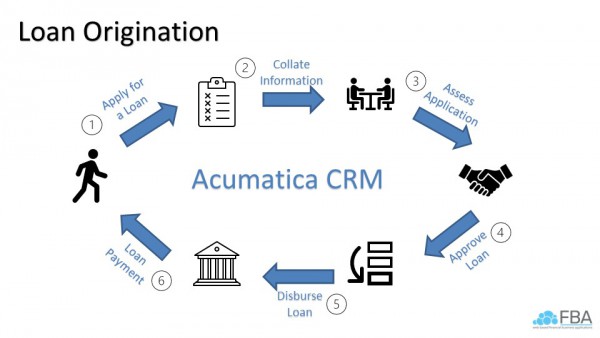

Life Cycle of a Loan in AcuLoan

The all-in-one loan management tool built for Acumatica has several components that make it a great fit for many different types of loans for companies in various industries. AcuLoan is built to serve both debtor and creditor types of loans making it a versatile loan management tool seamlessly integrated into Acumatica.

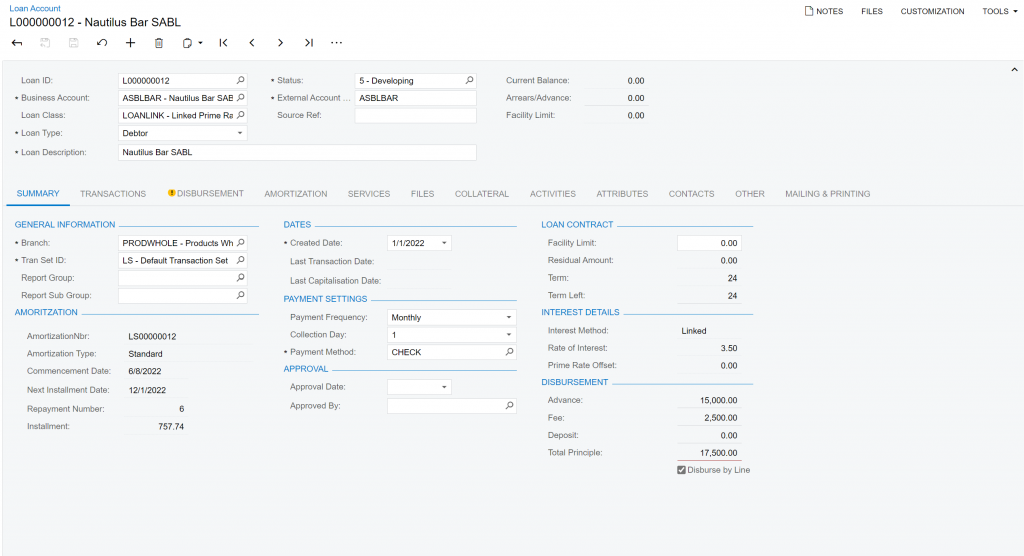

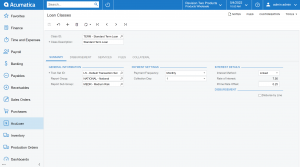

The life cycle of a loan is completely managed within the AcuLoan system. The loan is first entered into the system as a loan account with the “applied for” status. Users then leverage the Acumatica CRM system to assess the application and any documentation associated with the loan. Loans are then approved within the system and users make the payment within AcuLoan. All contact information for the loan account is held in the system for an easy user experience.

The all-in-one tool that Acumatica has for managing loan accounts makes it easy to see all information related to the loan and see how this information ties to accounting details. There is no longer a need for both a loan management program and an accounting program.

If you think your company could benefit from a single system to manage your loan accounts, contact Polaris Business Solutions for a demonstration of AcuLoan. Please email info@polaris-business.com.

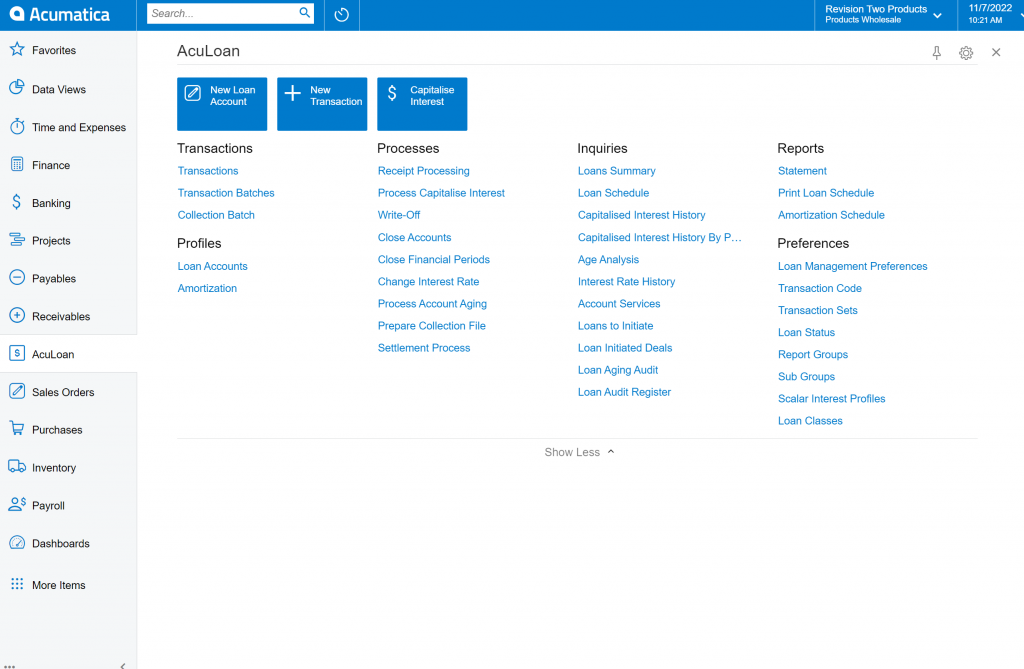

Creating a Report in AcuLoan

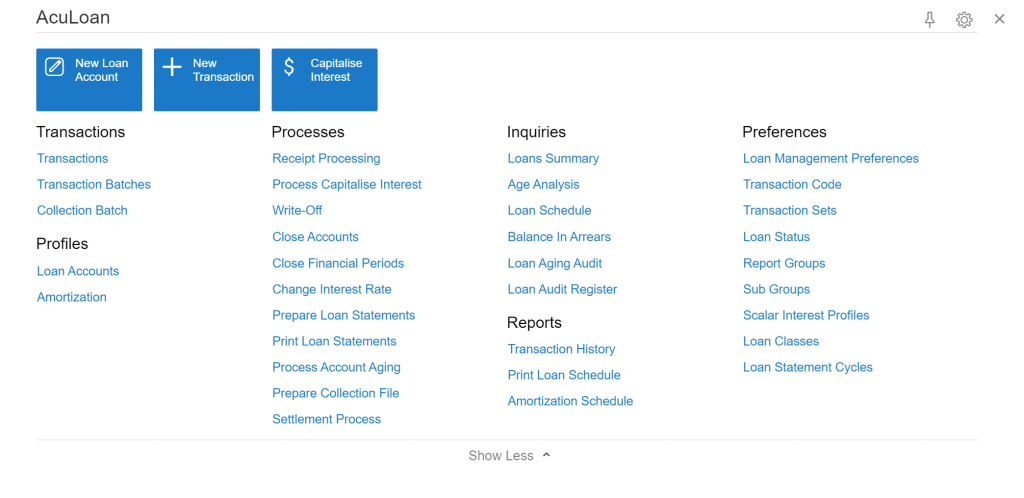

Like Acumatica, AcuLoan has several built-in reporting features that come out of the box. Reporting is essential to the management of loans and many of the reports in AcuLoan show vital information for keeping loans up-to-date, payments processed, and ensuring loans are transacting in the proper way. Some of the reports that are included with AcuLoan are the loan summary, loan schedule, and transaction history report. Above is a full view of the inquiries and reports available in the AcuLoan workspace.

These reports are run in the same way Acumatica reports are run. For example, below you read the steps on how a user can create a report in AcuLoan.

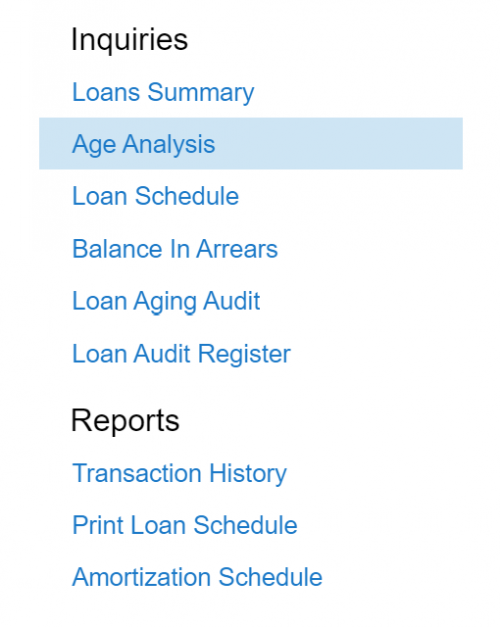

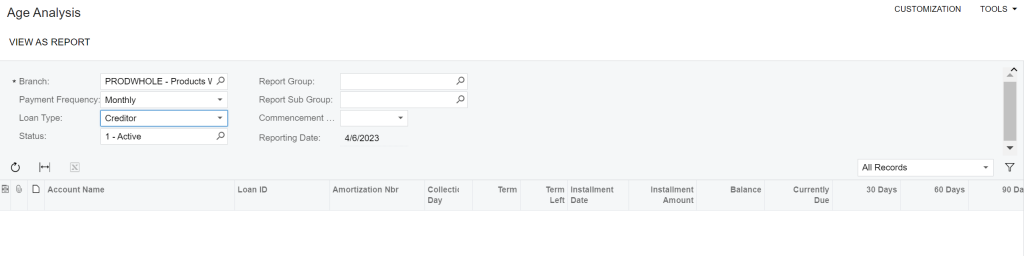

- Users will select the report or inquiry they choose to run. In this example, we will take a look at the Age Analysis Inquiry.

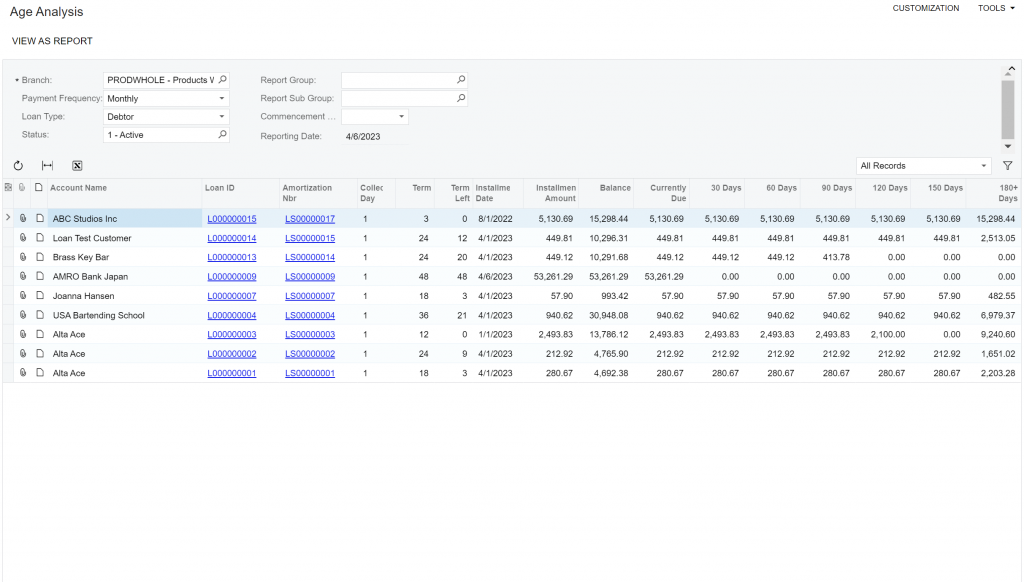

2. Once this loads on the screen, users will select the parameters for running the report.

3. Some of these selections in the header could include branch, loan type, payment frequency, dates, report group or sub group.

4. After selecting the necessary parameters, users will run the report.

4. After selecting the necessary parameters, users will run the report.

5. This will populate on the screen information for users to analyze.

Information in AcuLoan is updated in the same way Acumatica is updated. Real-time data in taken into account when reports are processed throughout the system. Reports and inquiries throughout both Acumatica and AcuLoan can be exported to Excel for further manipulation. Running reports in AcuLoan is a simple, single-system process. Users of AcuLoan access reports from one screen without having to leave Acumatica, this is a great benefit of the AcuLoan integration with Acumatica.

If you think your loan management process could benefit from an integrated reporting process, please reach out to Polaris Business Solutions. We would love to show you a full demo of AcuLoan and all of its great features; aculoan@polaris-business.com.

AcuLoan 2022 R1 and R2 updates

With every new release of Acumatica, comes a new release and updates to the integrated services. AcuLoan has a new release for 2022 R2 with several new interface updates, changes to the loan account profiles screen, and other user experience changes. Below is a brief outline of these updates.

As shown in the screenshot below there are several new features to AcuLoan. There is a new button to take users right to the amortization schedules for a loan account. Users now have the ability to prepare loan account statements with the click of a button. Additionally, under preferences, users can see the loan statement cycle linked to a specific loan account.

On the loan account profile screen, there have been several updates to the interface and user experience. On the statements tab, users can see the history of the statements for that specific loan. The statement tab is also a new feature. Along the top of the account profile screen, the amount for the loan that is in arrears is calculated and shows along the top without having to move to another screen. Also, the information from the amortization schedule is along the bottom left hand side of the loan account screen. On the mailing and printing tab, the same information as AR appears for users to see.

These are just a few of the updates to the AcuLoan system for 2022 R2. There are other, more specific updates to the system that affect some reporting and inquiry requirements. If you think these updates would be beneficial while managing your loan accounts, please contact Polaris Business Solutions at aculoan@polaris-business.com.

CDFI Conference

Last month Polaris Business Solutions attended the Opportunity Finance Network Annual Conference in New York City. The Opportunity Finance Network is a group of Community Development Financial Institutions (CDFIs) whose main goals are to help bridge the wealth gap from those in low-income, food deserts, and rural areas to those in cities with higher incomes. The purpose and goals of CDFIs are very empowering and important, and the time we spent at the conference was eye-opening in many different ways.

CDFIs are lenders with a special mission to help provide a fair, responsible financing opportunity to rural, native, and other communities without typical finance options. Although this may seem risky, there is a large opportunity to help those who need it most. Unlike a traditional bank, a CDFI lends to individuals, community organizations, and businesses in underserved areas all while coaching, educating, and helping build wealth – giving more than just money.

While attending the conference, we learned a lot about what the CDFIs are using for technology to track their loans, manage their AP/AR, and keep their overall businesses intact. Many CDFIs have several systems they use to track the same things within their industry leading to confusion, duplication, and errors in data. Polaris Business Solutions hopes to help CDFIs with their technology needs as we are continuing to educate ourselves about the growing and quickly changing industry.

We are eager to start on this journey and help an industry that helps so many other people. A trip to the Big Apple is always great, but a trip where we learned so much is even better!

AcuLoan 2022 R1 Amortization Table Updates

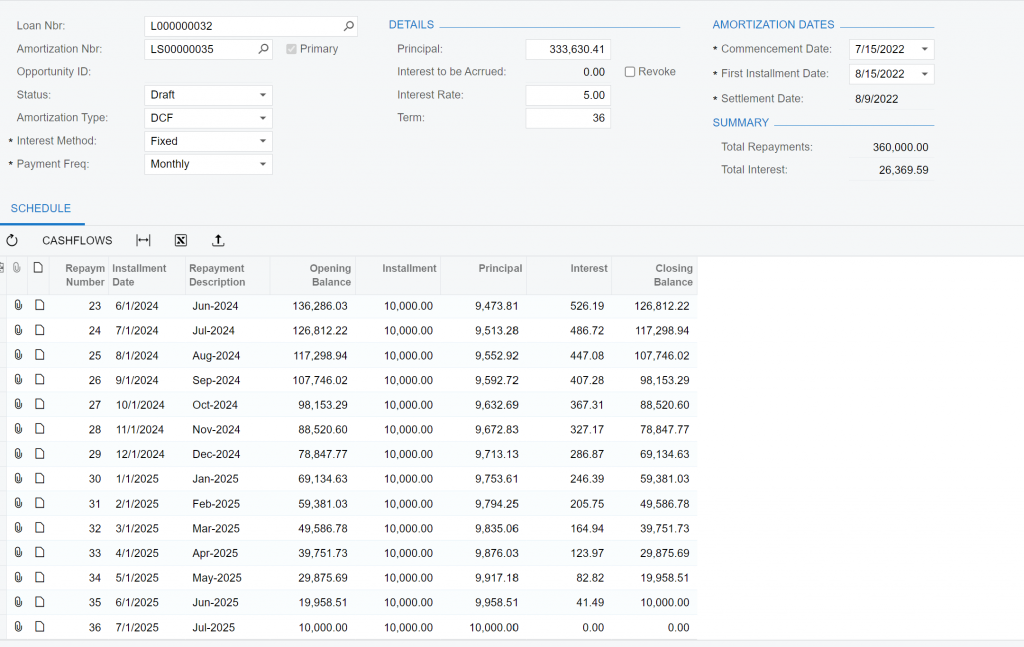

2022 R1 Feature Updates to Amortization Tables

Like Acumatica, AcuLoan has released a new update this year with a new set of features that have upgraded the system. The release of 2022 R1 has made changes to the amortization table. Before the updates to 2022 R1, there were only two ways to calculate using the amortization table. Those were standard and non-standard ways. With the update, see below for examples of how the amortization tables can now to calculated:

[…]

Users of AcuLoan

AcuLoan is a complete loan management and information software program designed to work fully within the Acumatica platform. The all-in-one loan management tool has several components that make it a great fit for several different types of loans and companies. […]

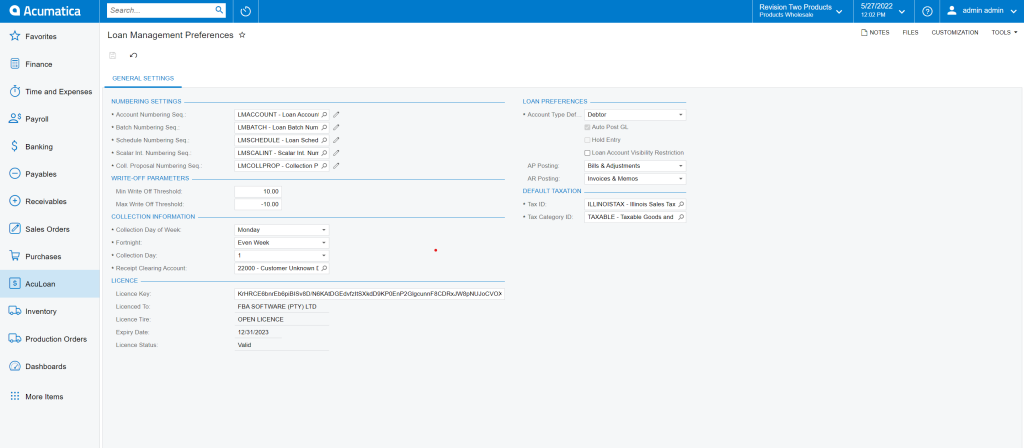

Loan Management Preferences in AcuLoan

The AcuLoan system has several different Loan Management Preferences that are set up during the implementation phase. These preferences allow for a more custom system. Users can see numbering settings, write-off parameters, collection information, loan preferences, and taxation of the preferences screen from the AcuLoan dashboard.

Loan Book Dashboard Overview

Like Acumatica, AcuLoan has its own dashboard that can be configured to best fit your needs. This dashboard is configured and designed the same as any other dashboard in Acumatica using the design feature along the top right-hand side of the screen (you can see this in the screenshot above). The AcuLoan dashboard is called the Loan Book Overview.

In the photo below, users will see what the Loan Book Overview dashboard looks like and what tiles are and graphs are available to configure.

On the Loan Book Overview Dashboard, there are several configurable tiles. These help users to see an overview of their loans and accounts in AcuLoan. In this specific dashboard view you can see several things:

• Total Book Value

• Advanced Payments Disbursed

• Receipts Payments Received

• Different Trends – deal size and capitalized interest

• Actual vs. Budget – Income

• View of Certain Loans

There are several other items that can be included on a dashboard for AcuLoan. These tiles and graphs have many customization options. The colors can be changed as well as the thresholds which prompt the tile to “alert.” Dashboards in the AcuLoan program from Acumatica are a great way to get an overview of what is happening in the system. These dashboards can be configured one time for multiple users to see.

If you think you could use a dashboard like this for your loan data, please contact Polaris Business Solutions; info@polaris-business.com.