Types of Loans to Track in AcuLoan

The all-in-one loan management tool built for Acumatica has several components that make it an excellent fit for various types of loans for companies in various industries. AcuLoan is built to serve both debtor and creditor types of loans making it a versatile loan management tool seamlessly integrated into Acumatica.

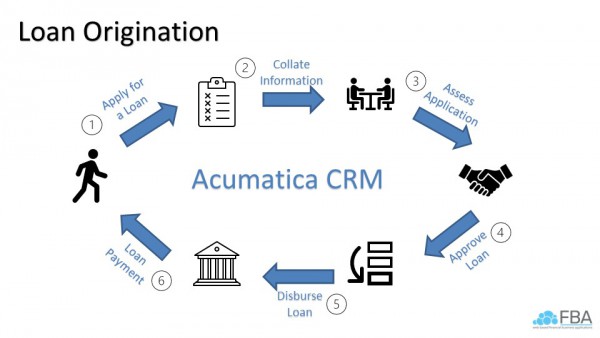

Loans are managed using the Acumatica CRM system, pushing the data through to the AcuLoan module. Loan details, transactions, and payments are centered in a single system making for an easy user experience.

The types of loans that are the best for the AcuLoan platform are:

- Installment Loans

- Fixed Term Loans

- Short Term Loans

- Employee Loans

- Student Loans

- Housing / Vehicle Loans

Life Cycle of a Loan

The life cycle of a loan is completed and managed within the AcuLoan system. The loan is first entered into the system as a loan account as the “applied for” status. Users then leverage the Acumatica CRM system to assess the application and any documentation associated with the loan. Loans are then approved by the system and users make the payment within AcuLoan. All contact information for the loan account is held in the system for an easy user experience.

If you want to learn more about whether or not AcuLoan might be the loan management system for you then check out some of the free content below:

If you think that AcuLoan might be for you then you can reach us at: aculoan@polaris-business.com